Over the past 40 years, globalization has profoundly influenced digital banking transformation. Globally-operated banks took advantage of digital transformation firms and financial software development firms, allowing them to capitalize on new digital technologies. This allowed them to integrate into national banking systems and capture a substantial market share. The nature of business operations has transformed. Mobile technologies, cloud computing, machine learning algorithms, and big data analytics have become crucial for internationally competitive banks.

New advanced digital technologies introduced new players to the banking sector. Some of these FinTech companies are competing with established banks, forcing banks to innovate and digitalize, thereby accelerating their digital transformation. On the other hand, financial IT companies and digital transformation firms serve as valuable allies to established banks. These firms possess unique IT skill sets and experience, allowing for seamless banking transformation when IT solutions are outsourced to them.

Financial software development companies and digital transformation firms are thus crucial for traditional banks to reimagine their business processes, enhance customer experiences, and drive operational efficiency through advanced digital technologies, often at lower costs than developing everything in-house.

Innovation Hotspots

A significant portion of the development and commercialization of key financial technologies and software is occurring in major cities and metropolitan areas. While Silicon Valley is especially renowned for its high-tech innovations and software development companies, New York and London are also widely regarded as the world’s largest innovation hubs at the forefront of banking transformation, particularly in fintech and cybersecurity.

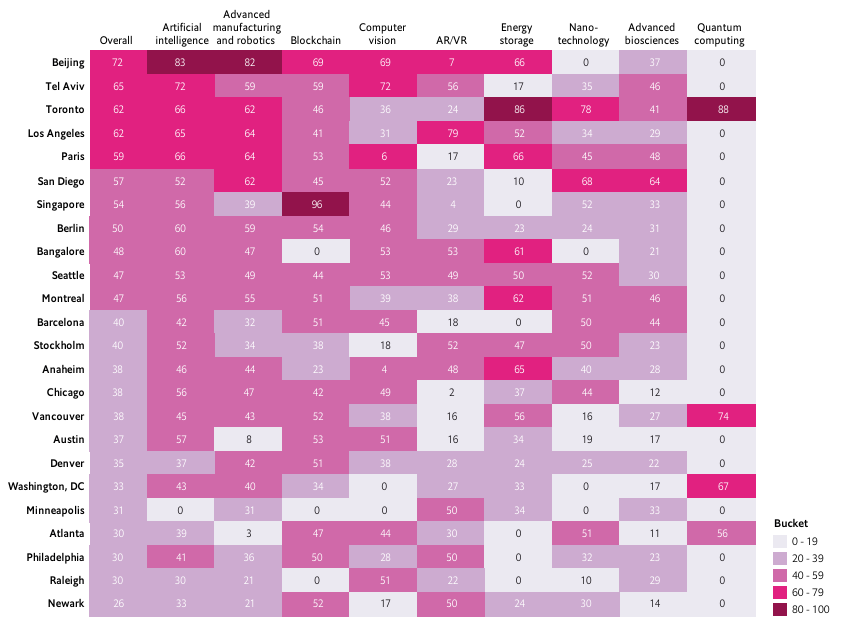

Nevertheless, the dominance of these traditional tech hubs is being increasingly challenged, as highlighted by the Economist Intelligence Unit report “Uncovering Tomorrow’s Innovation Hotspots: The Cities Striving for Emerging Technology Leadership.” As early as 2018, The Economist questioned whether Silicon Valley had peaked. One significant factor are high living costs in these leading tech hubs, which is pushing young entrepreneurs to seek more affordable locations. Cities like Beijing, Los Angeles, Paris, and Tel Aviv are emerging as new hotspots for digital transformation firms and IT companies, driving banking transformation and advancing fintech innovations in AI and blockchain.

According to the Economist Intelligence Unit study, which uses venture capital funding as a key indicator, 24 cities exhibit significant scale and rapid growth. These cities deserve close attention as potential challengers to today’s leading high-tech hubs. Their advancements in 10 key technologies are illustrated in the accompanying figure, with scores normalized relative to the performance of other cities, where 100 represents the highest score. Notably, the study focused on emerging innovation challengers, excluding traditional tech hubs such as New York.

Among digital technologies and banking digital transformation, the AI race is increasingly crucial today. While public strategies for establishing AI hubs vary widely across different regions, it is common for governments and local authorities to make significant investments in research and development. Moreover, some regions focus on building partnerships between universities, digital transformation firms, tech startups and software development companies, while others prioritize infrastructure improvements and funding opportunities for AI-focused initiatives. For example, Germany’s Federal Government plans to invest three billion euros over the next five years in various research and business sectors. Meanwhile, the State of Hessen will establish a new AI-oriented institute for applied research and business development and digital transformation, committing one billion euros over the same period to advance digitalization efforts.

These advancements provide substantial support to local digital transformation firms and financial software development companies. They in turn drive digital banking transformation, enabling traditional banks to leverage cutting-edge technologies to enhance their services and maintain their competitiveness. Real-time monitoring with AI, for example, can significantly boost the competitiveness of banks by providing instant insights and proactive solutions to potential issues.

Leveraging Tech Hubs: Choosing the Right IT Solution Provider for Banking transformation

With the rapid emergence and increasing complexity of financial software companies, banking digital transformation providers, and digital technologies, selecting the right IT solutions provider is crucial for banks. But why is this so important? If banks neglect to adequately protect their clients’ financial and personal data, they expose consumers to significant risks. Crimes such as online theft from digital wallets and credit cards, as well as money laundering through digital channels, are common threats that accompany digital advancements.

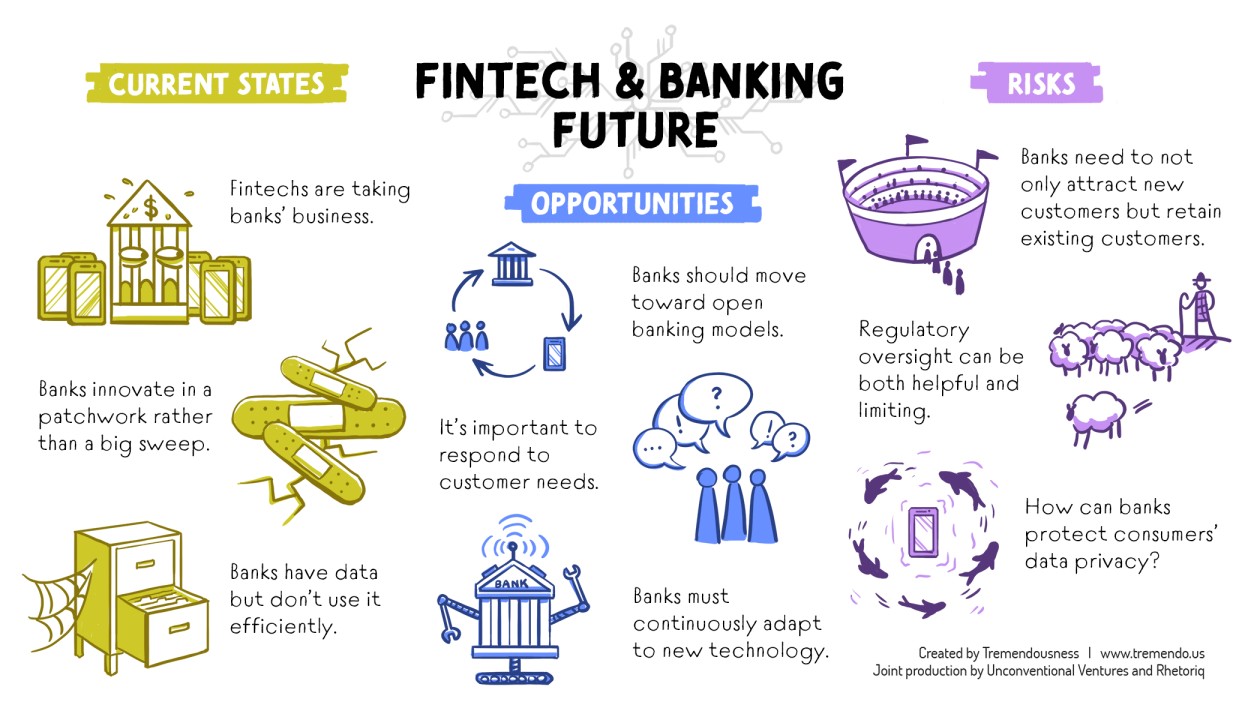

The accompanying image illustrates the current states, opportunities, and risks in the future of FinTech and banking. It highlights that FinTechs are taking business from traditional banks, and banks often innovate in a fragmented manner. Furthermore, banks possess valuable data but struggle to use it efficiently. Opportunities for banks include moving toward open banking models, responding to customer needs, and continuously adapting to new technology.

In this context, banking transformation is driven by digital transformation firms and financial software development companies. These entities provide the expertise and technological solutions necessary for banks to navigate the competitive landscape, secure their operations, and innovate effectively. By partnering with the right digital transformation firm, banks can harness advanced technologies to protect consumer data, improve operational efficiency, and stay ahead of emerging threats and opportunities in the financial sector.

A financial software development company with 17-year tradition, that can seamlessly help with your bank’s digital transformation needs is Sprinterra. We are global company specializing in custom software solutions, digital platform engineering, data processing and management, blockchain solutions, payment system architecture, compliance, financial planning and reporting and digital transformation for banks.

Still not convinced? Tech hubs have revolutionized the banking system, and staying ahead in the industry requires embracing digitalization. A study has shown that while the costs of digitalizing banks are significant, this transformation is crucial for the long-term profitability of financial institutions. Through the innovative efforts of digital transformation firms and financial software development companies like Sprinterra, banking transformation has never been easier.

From our HQ in New York to more than 13 high-tech hubs in other developed countries, Sprinterra’s global footprint is a vibrant ecosystem of innovation, progress, and global leadership. With a team of over 100 in-house engineers and a portfolio of 500+ successful projects, we combine deep expertise with a commitment to excellence, ensuring that our software solutions set the benchmark for quality and innovation in the banking industry.

With all those advantages in mind, imagine doing it without Sprinterra – a financial software development company you can trust.

Subscribe To Our Newsletter

Get the latest insights on exponential technologies delivered straight to you