The banking sector is in the midst of a dynamic evolution, propelled by shifting customer expectations and intensifying competition from tech-based non-banking entities. To remain relevant and competitive, banks are increasingly turning to advanced technologies and adopting data-centric approaches. Digital-only banks and financial technology consulting firms are reshaping the traditional banking framework, drawing considerable attention worldwide. In the United States, the customer base for digital-only banks is forecasted to expand to 47.5 million by 2024, signifying robust growth.

Key trends are currently shaping the banking landscape. Customers, influenced by the seamless experiences provided by major technology companies, now demand similar levels of convenience and innovation in their financial services. Banks are responding by investing in hyper-personalization, utilizing AI and machine learning to analyze customer behaviors and generate tailored financial advice.

To appeal to younger customers, particularly millennials and Gen Z, who predominantly use digital channels for banking, banks are revising their business models to become more data-centric. This shift is necessitated by the digital preferences of these tech-savvy demographics.

Moreover, the entrance of tech firms into banking and payment services has spurred further innovation in service delivery and real-time processing. Big tech and FinTech companies are targeting younger customers with holistic experiences prioritizing convenience and efficiency.

To successfully navigate these changes and achieve digital transformation, banks frequently collaborate with banking consulting and financial technology consulting firms. These firms offer expertise in banking technology, IT services for banks, and global banking solutions. They guide banks in developing digital strategies, selecting appropriate digital banking software, and implementing cloud-based core banking systems.

Cloud-based banking solutions are crucial in this transition, providing scalability, flexibility, and cost-efficiency. These platforms enable banks to streamline their infrastructure, cut operational costs, and increase agility, all while ensuring data security and compliance.

Achieve Agility: Traditionally, banking cores have been characterized by monolithic, often mainframe-based applications that can stifle innovation. Even seemingly simple updates can take up to a month, while major enhancements may require a year to implement. In today’s fast-paced world, where the emphasis is on delivering improved customer experiences and rapidly introducing innovative products to the market, a core system that cannot support these demands becomes a hindrance. An API-enabled, cloud-based core can leverage microservices to develop and seamlessly integrate new solutions quickly and efficiently.

Enhance IT and Operational Flexibility: While many banks initially view cloud computing as a means to save costs and shift from capital to operational expenditure, its benefits go beyond financial considerations. The cloud can also reduce inefficiencies within a bank’s IT and operational functions. For most banks, maintaining an in-house data center operation constitutes a significant overhead and does not contribute to their core value proposition. A cloud-enabled core liberates a bank from this burden and provides a pathway to digitize IT operations. Valuable resources can be redirected from routine tasks like core maintenance to activities that genuinely enhance customer value.

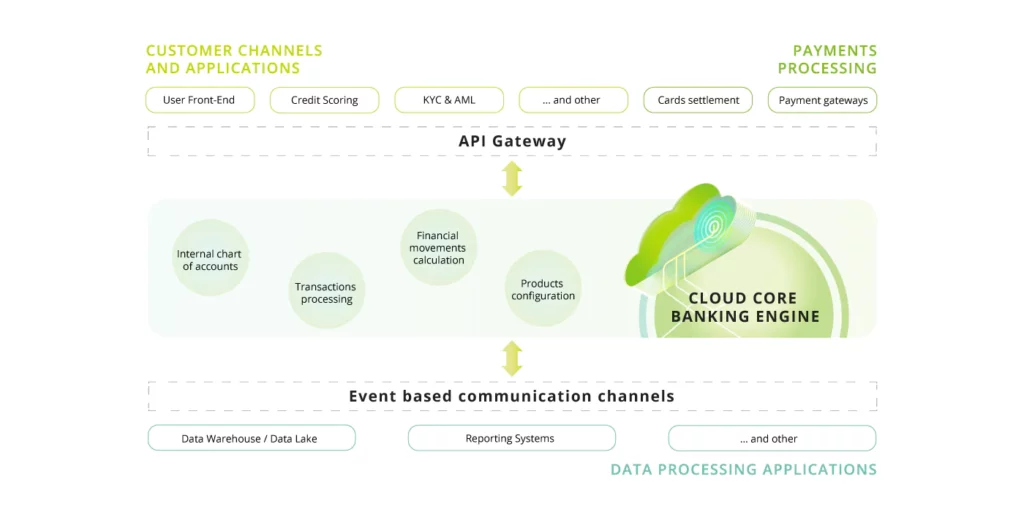

Accelerate Solution Deployment Through APIs: Banking has embraced the digital era, with over 90 percent of customer interactions now occurring through mobile apps or websites. Banks are fiercely competing to deliver distinctive and compelling digital experiences that attract and retain new customers. Their performance is often evaluated based on the quality, depth, and richness of the customer experience, which is powered by the core system. If this core system is cloud-enabled through microservices and APIs, the bank is well-positioned to open up new channels by using API-based services to connect with partners, regulatory bodies, and various internal departments within the organization.

Before embarking on the migration to a new cloud-based core banking system, banks should carefully consider the following key concepts:

Embarking on the journey towards cloud infrastructure and the adoption of a cloud-native core banking solution can be a challenging endeavor. Therefore, we would like to share key insights gleaned from our previous experiences in such transformations. Some of these insights may seem obvious at the outset of a transformation but can be overlooked or neglected over time, especially in multi-year transformation projects. It is advisable to equip the transformation team with a checklist of essential tasks for a successful execution, which should be periodically reviewed, ideally every 3 to 6 months. We recommend incorporating the following items into the migration to a cloud core banking platform:

Effective Change Management

Embrace the Philosophy of Cloud Core Banking Systems: Recognize that the design approach of a cloud core banking software differs from legacy core banking software. Promote the concept of a composable architecture internally to avoid direct comparisons between the two solutions.

Clear Architectural Vision:

Define a High-Level Architecture and Key Principles: Agree on a clear architectural vision and guiding principles and adhere to them throughout the implementation process. Pay special attention to cleanly separating responsibilities between systems while keeping their capabilities in mind. In cases of uncertainty about functionality or architectural decisions, consider creating quick proof-of-concept demonstrations for evaluation.

Agile Approach:

Adopt an Agile Way of Working: Agile methodologies are typically the default choice for cloud implementations. However, ensure that there is an appropriate level of supervision and reporting for executives to instill confidence in this critical change, such as replacing a core banking system. Additionally, when planning a full replacement of core banking software, consider initiating the implementation with a single banking product or a new business line offering and gradually migrating satellite systems into the cloud banking infrastructure.

Shared Ownership:

Distribute Transformation Ownership: Divide the ownership of the transformation between the business and IT, and form a joint team with shared objectives. Make project-related decisions through groups consisting of both business and IT representatives to ensure that business teams remain informed about implemented changes that may affect their routine processes.

IT Transformation Management:

Acknowledge the Challenge for IT Specialists: Understand that transformations can be challenging for IT specialists, as they redefine existing maintenance and operating teams, render current competencies obsolete, replace in-house developed software, and necessitate the acquisition of new skills. Proper management of the IT function transformation is essential and unavoidable.

Data and Configuration Cleanup:

Implement Cleanup: During transformation and migration, consider cleaning up existing unused data and configurations that have accumulated within IT systems over the years. This cleanup effort may involve tasks such as data warehouse purging, discontinuing products that remain on the books with no recent activity, streamlining complex fee and commission structures, and more.

Incorporating these practices into your cloud core banking system migration can help enhance the success and efficiency of the transformation journey.

Establish a Development Environment:

Banks can initiate their transformation by enabling the development of applications, architecture, and partner solutions that are inherently designed for the cloud and leverage microservices. This entails utilizing containers like Docker or Kubernetes, as well as platforms such as OpenShift or Pivotal.

The adoption of a microservices approach offers several advantageous features, including reusability, swift updates, flexibility, and scalability. These characteristics are particularly valuable for banking applications that interact directly with customers, manage substantial user loads, and experience fluctuating and sometimes unpredictable usage patterns. Examples of such applications include mobile banking, payment processing, and trading platforms.

Simple Application Migrations

At this stage of migration, non-critical back-office applications that do not justify the cost of a complete rewrite for cloud compatibility and off-the-shelf applications can be smoothly transitioned to the cloud. In many cases, these migrations require minimal to no code modifications. Some common examples include Enterprise Resource Planning (ERP) systems, Human Resources (HR) software, email services, and collaboration platforms.

Component Rearchitecture or Replacement

Component Rearchitecture or Repla In this stage, banks should consider breaking down their monolithic core systems into subcomponents organized by specific business functions. These subcomponents can then be revamped or substituted with cloud-native microservices-based solutions that are user-friendly and seamlessly integrable.

Prime candidates for decoupling from the core system include business functions such as customer management, catalog management, pricing, and analytics. These functions offer enhanced scalability and flexibility for banks. This approach empowers these functions to be scaled up and extended to serve the entire enterprise efficiently.

Core Modernization

In this final stage, banks should focus on a comprehensive transformation of their legacy core applications, transitioning them from mainframe systems to the cloud.

Many banks will find it necessary to undergo a complete overhaul of their core systems, rewriting them to embrace a cloud-native architecture, given that most legacy cores still rely on mainframe technology and are monolithic in nature.

From an industry standpoint, approximately 19% of banks in the US and Europe have already migrated some of their applications to the cloud. However, a significant 52% of banks have just begun their journey towards cloud adoption.

Anticipating the years ahead, we expect to witness a substantial surge in core modernization efforts, as banks move towards adopting a streamlined and secure modern core processing engine designed to operate seamlessly in the cloud environment.

Core banking solutions play a pivotal role in modern banking, serving as a linchpin for operational efficiency and customer satisfaction. Their significance is underscored by the following compelling reasons:

In essence, core banking solutions are the backbone of modern banking, delivering a blend of efficiency, accessibility, cost-effectiveness, enhanced customer service, and risk mitigation.

Various core banking solutions are tailored to address distinct needs and facets of banking operations, encompassing the following primary types:

In summary, a spectrum of core banking solutions exists, each specifically engineered to address the unique demands of various banking sectors, including retail, corporate, universal, and private banking, ultimately contributing to the efficient and specialized functioning of financial institutions.

Before embarking on the migration to a new cloud-based core banking system, banks should carefully grasp and consider several crucial concepts:

Embarking on the transformation journey toward cloud infrastructure and adopting a cloud-native core banking solution can present its fair share of challenges. As such, we would like to highlight key lessons learned from our previous engagements. While some of these lessons may seem apparent at the outset of a transformation initiative, they can sometimes be overlooked or sidelined, particularly as the transformation progresses over several years. It is advisable to arm the transformation team with a checklist of essential tasks crucial for successful execution, which should be periodically reviewed every 3 to 6 months. We recommend incorporating at least the following items into the migration to a cloud core banking platform:

1. Customer Relationship Management (CRM): CRM plays a pivotal role in overseeing all dimensions of a bank’s customer relationships. It serves to identify potential customers, manage existing relationships, and deliver exceptional customer service.

2. Deposit and Loan Management: Responsible for the comprehensive management of deposit and loan products, this component handles tasks such as account creation, interest calculation, payment processing, and more.

3. Payment and Transaction Processing: Encompassing all financial transactions, this component ensures the seamless handling of deposits, withdrawals, fund transfers, and bill payments. Its primary objective is to guarantee the accurate and efficient processing of all monetary transactions.

4. Risk Management and Compliance: This component assists banks in identifying, assessing, and effectively managing various risks, including credit, market, and operational risks. Furthermore, it ensures adherence to diverse banking regulations and standards.

5. Financial Reporting and Analysis: Banks utilize this component to generate financial reports, both for internal purposes and external stakeholders. It offers valuable insights into the financial well-being of the bank and facilitates informed decision-making.

6. Security Module: Safeguarding the integrity of banking operations, data, and transactions is the core mission of this module. It encompasses security measures such as encryption, user authentication, and access control to thwart unauthorized access and fraud attempts.

The architecture of a Core Banking System (CBS) is typically structured in a multi-tiered framework, meticulously designed to enhance scalability, optimize performance, and bolster security.

Data Layer: At the foundation of this architecture lies the data layer, serving as the bedrock where the entirety of the bank’s crucial data resides. This includes a secure repository for customer information, transaction records, and account data, safeguarded with the utmost diligence.

·Business Logic Layer: Positioned immediately above the data layer, the business logic layer encapsulates the heart of the banking system’s functionality. Within this layer, transactions are meticulously processed, accounts are adeptly managed, and the full spectrum of banking operations is expertly orchestrated.

Application Layer: Nestled above the business logic layer, the application layer serves as the gateway that directly interfaces with end-users, whether they be bank employees or customers accessing digital platforms. Within this stratum, a rich array of user interfaces and applications is thoughtfully cultivated to deliver diverse banking services with finesse.

Integration Layer: Crowned atop this architectural hierarchy is the integration layer, a critical conduit that enables seamless communication between the core banking system and external systems. This layer orchestrates interactions with pivotal components such as ATMs, payment gateways, mobile banking applications, and more.

These layers collaborate harmoniously, communicating as the need arises, to ensure the uninterrupted flow of operations. This modular design empowers banks to effect changes or enhancements within a specific layer without impinging upon the integrity of the others. It thereby affords banks the agility to readily embrace evolving technological innovations and adapt to shifting landscapes with ease.

Core Banking Solutions (CBS) play a pivotal role in centralizing and automating banking operations. At the core of CBS lies a robust database that serves as the repository for a wealth of critical information, including customer profiles, account particulars, transaction records, and other pertinent data. Importantly, this database updates in real-time as transactions are executed.

When a customer initiates a transaction—whether it’s making a deposit, withdrawing funds, or transferring money—CBS springs into action. The system meticulously processes the transaction, first verifying the customer’s identity and subsequently scrutinizing account balances to ensure sufficient funds. Simultaneously, it updates the customer’s account as warranted, leaving an indelible record of the transaction within the customer’s account history.

For bank employees, CBS offers an array of tools that simplify the management of customer accounts, streamline transaction processing, and facilitate customer service. This includes the capability to execute administrative functions such as opening new accounts and handling loan applications with efficiency.

In essence, CBS functions as the digital backbone of a bank, orchestrating seamless operations and enhancing the convenience of banking for both customers and bank employees alike.

The implementation of a Core Banking Solution (CBS) holds the promise of numerous benefits, yet it is an intricate process accompanied by its own set of challenges:

1.Data Migration: Transferring data from the old system to the new CBS is a formidable task that demands meticulous management. It is imperative to ensure the accurate and secure transfer of all data while safeguarding against any loss or corruption.

2.Integration with Existing Systems: Banks often employ a diverse array of technologies to fulfill various functions. The integration of the new CBS with these pre-existing systems can prove to be intricate, and errors in this process may disrupt critical banking operations.

3. Staff Training: Equipping employees with the necessary skills to effectively utilize the new CBS is a crucial step. While this training can be time-consuming and incur costs, there is the inherent risk that employees may require ongoing assistance as they adapt to the new system.

4. Business Disruption: The implementation of a new CBS has the potential to disrupt regular banking operations. It is of paramount importance to meticulously manage this process to minimize its impact on customers.

5. Regulatory Compliance: The new CBS must diligently adhere to all pertinent banking regulations. The complexity increases, particularly if regulatory rules undergo changes during the implementation phase.

6. Vendor Dependence: Banks heavily rely on the CBS vendor for essential support and updates. Challenges may arise if the vendor’s performance falls short of expectations or if the vendor faces operational difficulties, such as going out of business.

7. Scalability and Future-Proofing: The new CBS must possess the inherent capability to scale in accordance with the bank’s growth and exhibit adaptability to accommodate forthcoming alterations in banking technology and practices. Predicting these future needs can prove to be a daunting task.

In navigating these challenges, the successful implementation of a CBS offers the potential for a more streamlined and efficient banking environment, ultimately benefiting both the bank and its customers.

Core banking solutions are continuously evolving in tandem with technological advancements. Here, we highlight some noteworthy trends shaping the landscape of core banking solutions:

1. Adoption of Cloud-Based Solutions: The prevalence of cloud-based solutions in core banking is on the ascent, driven by their scalability, flexibility, and cost-effectiveness. These solutions empower banks to efficiently manage and access data from any location, while simultaneously curtailing infrastructure expenses. Furthermore, they facilitate rapid adaptation to shifting demands. Cloud solutions also offer robust disaster recovery capabilities and expedite the deployment of new features and services.

2. Integration of AI and ML: The integration of Artificial Intelligence (AI) and Machine Learning (ML) is gaining prominence within core banking solutions, enhancing various facets of banking operations, including customer service, fraud detection, and risk management. AI fuels the deployment of chatbots for round-the-clock customer support, while ML algorithms delve into vast transaction datasets to discern patterns, thereby improving the accuracy of fraud detection and credit risk assessment.

3. Utilization of APIs for Third-Party Integration: Application Programming Interfaces (APIs) are becoming increasingly pervasive in core banking systems, simplifying integration with third-party services. This opens doors to an expanded array of services, ultimately enriching the overall customer experience. For instance, through APIs, banks can seamlessly interface with FinTech services, payment gateways, and even other financial institutions for smooth interbank transactions.

4. Leveraging Blockchain Technology: Blockchain technology holds substantial promise for core banking due to its attributes of transparency, security, and decentralization. It establishes an immutable transaction ledger, simplifying auditing processes and rendering fraud more challenging. Blockchain also streamlines cross-border payments and remittances, resulting in cost reductions and accelerated transaction speeds. While still in its nascent stages, the integration of blockchain within Core Banking Systems (CBS) represents an emerging trend with considerable potential.

Technology plays a pivotal role in the realm of Core Banking Systems (CBS), enabling them to deliver efficient, reliable, and innovative services. It serves as the driving force behind the automation of a multitude of banking processes within CBS, ranging from account management to transaction processing. This automation not only reduces manual effort but also mitigates the likelihood of errors, thereby elevating operational efficiency and expediting processes.

Leveraging technology, CBS systems are capable of executing and updating transactions in real time, ensuring that account information remains consistently up-to-date. Additionally, contemporary technology empowers CBS to adeptly manage and process extensive volumes of data, all while maintaining a high standard of security and delivering an exceptional customer experience.

Moreover, the advent of emerging technologies such as Artificial Intelligence (AI), machine learning, blockchain, and cloud computing opens new horizons for innovation within CBS. These technologies pave the way for the creation of more personalized banking services, bolstered security measures, heightened compliance standards, and enhanced overall operational efficiency.

Here are the top five core banking software solutions currently available:

Selecting the optimal Core Banking Solution (CBS) for your organization is a pivotal decision that necessitates meticulous consideration of several pivotal factors:

1. Thorough Needs Assessment: Initiate the selection process by conducting an exhaustive needs assessment. This entails identifying your organization’s precise requirements, addressing current pain points, and outlining objectives for the CBS implementation. Be sure to encompass both technical specifications and overarching business needs, such as enhancing customer experiences, expanding product portfolios, or optimizing operational efficiency. Factors to contemplate include the types of accounts your bank offers, the volume and complexity of transactions, regulatory mandates, and the imperative for real-time processing, risk management, and analytics. It is instrumental to consult with stakeholders across the spectrum, including IT personnel, bank executives, and frontline staff, to gain a comprehensive understanding of your organization’s unique needs.

2. Scalability: An imperative facet to weigh is the scalability of the chosen CBS. As your organization evolves and expands, the CBS should effortlessly accommodate an increased influx of transactions, a growing number of accounts, and the introduction of more intricate banking products and services. The system’s scalability should facilitate growth without substantially escalating operational complexities or costs. Moreover, it should possess the flexibility to handle periods of reduced demand. A CBS that can scale effectively will safeguard your technology investment and ensure long-term support for your organization’s growth endeavors.

3. Emphasis on Security: Security constitutes a non-negotiable priority in the realm of banking. The selected CBS should be fortified with robust security measures to shield sensitive customer data and financial transactions. This encompasses stringent data encryption, secure user authentication protocols, intrusion detection systems, and the prompt incorporation of security updates. Furthermore, the system’s design should adhere to pertinent security regulations and standards. Additionally, assess the vendor’s approach to cybersecurity, encompassing their policies for managing potential security incidents and their track record in mitigating security risks.

4. Integration Capabilities: Given the intricately interconnected nature of banking operations, it is imperative that your CBS seamlessly integrates with a diverse array of other banking systems. This includes your bank’s existing IT infrastructure, digital banking platforms, payment gateways, third-party services, and more. The CBS should offer flexible integration capabilities through Application Programming Interfaces (APIs), facilitating seamless interoperability with these systems. This ensures that the CBS can effectively harmonize with your existing technology ecosystem and support an extensive spectrum of services.

Vendor’s Support and Reliability: The chosen CBS vendor should provide comprehensive support throughout the implementation phase and offer ongoing technical assistance. Scrutinize their track record concerning system uptime, issue resolution proficiency, and customer satisfaction levels. It is prudent to assess the vendor’s financial stability and their dedication to investing in product development. A dependable vendor will deliver a high-quality product and serve as a valuable partner in your organization’s journey toward digital transformation.

© 2025 Sprinterra. All rights reserved.