In 2023, U.S. banks faced over $33 million in fines for sanctions violations. Financial institutions encounter challenges in sanctions screening for various reasons, including outdated sanction lists and backlogged governmental reports.

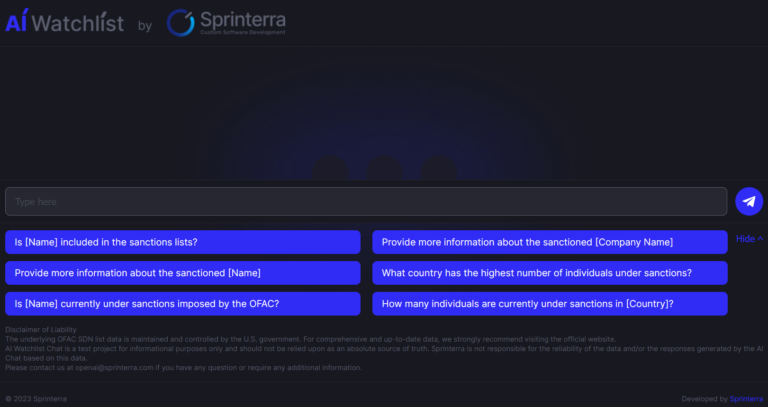

Recognizing these challenges, Sprinterra has developed a prototype of an AI-powered sanctions screening tool, the AI WatchList Chat, designed to improve and streamline this crucial compliance process.

Our newest AI tool combats outdated practices and integrates seamlessly into the broader financial crime risk management strategy. The AI WatchList Chat is a testament to our commitment to innovation and professional growth.

Conceived during our team’s exploration of AI technologies, this tool exemplifies the potential of custom software development for various industries, but will be the most beneficial for the financial institutions and banks. It’s not just a product; it’s a reflection of our journey in understanding and utilizing AI to create tailor-made solutions. The best part? The free demo version is available to anyone interested in checking it out!

The AI Watchlist Chat showcases the versatility of the OpenAI API in processing natural language. It’s an intuitive, conversational tool designed for real-time screening and analysis of sanctioned individuals and entities, drawing data from the Office of Foreign Assets Control Specially Designated Nationals List (OFAC SDN List).

Our AI solution is built on cutting-edge technology, trained exclusively on specific datasets like the OFAC SDN list. By normalizing and storing this data in the Sprinterra Cloud DB, we’ve created a system that’s both responsive and scalable.

Sprinterra’s path to developing this advanced AI tool involved unique challenges. Initially, we used LlamaIndex, a library based on the concept of Retrieval Augmented Generation (RAG), which helped simplify chatbot development. Despite its initial promise, we encountered limitations in handling complex calculations and resource-intensive processes.

This led us to pivot to CODEX, which, combined with GPT-4, allowed us to train the AI to understand human language and effectively generate SQL queries. This shift was crucial in extracting data from our normalized database and translating it into coherent human responses with GPT-4.

Next, the transition from LlamaIndex to CODEX marked a significant step in our project. While LlamaIndex laid the groundwork, CODEX offered enhanced capabilities, especially in interacting with structured list data. AI models often struggle with numerical statistics and structured documents, but our solution, AI Watchlist, overcomes these challenges by integrating conversational capabilities with precise database queries.

While our AI Chat offers advanced capabilities, we acknowledge certain limitations, such as the reliance on database-stored files and character limits in responses. Continual fine-tuning of the model is essential to enhance response accuracy.

While this tool was initially a learning project, its potential applications are vast. It’s particularly beneficial for financial institutions like banks, credit unions, and investment companies, aiding in customer screening and AML compliance.

At Sprinterra, we’re not just creating tools; we’re crafting solutions that blend the latest AI technology with the specific needs of our clients. Let’s embark on this journey of innovation and compliance together. Experience the power of AI in transforming your compliance strategies. Reach out to Sprinterra, and let’s explore how our AI solutions can revolutionize your approach to sanctions screening and regulatory adherence.

Join Us in Pioneering the Future of AI-Driven Compliance!

Get the latest insights on exponential technologies delivered straight to you

© 2025 Sprinterra. All rights reserved.