The software market is currently experiencing significant disturbances and changes. With emerging technologies, businesses recognize digital transformation as key to success and staying ahead of the competition. Leading companies are leveraging cutting-edge technologies and software to update their operations, increase efficiency, and improve customer experiences.

Even in banking, which was a traditionally very resistant sector to technological change, crisis of 2008 sparked a surge in FinTech startups globally, challenging the status quo.

Over the past decade, the traditional banking industry has experienced considerable disruption, particularly in payments, lending, wealth management, and retail banking. This transformation hasn’t been limited to FinTech startups; established banks are also adapting to the changing landscape to meet new consumer expectations.

Despite the urgency for business development and modernization, did you know that 70 % of business today fail to complete their digital transformation initiatives? Learn how Sprinterra can help with your business development, including product development and automation.

Businesses and banks are on the hunt for software that can automate processes and utilize data analytics to boost business insights and operational efficiency. The software-as-a-service (SaaS) model, in particular, is gaining widespread popularity among both individuals and companies. SaaS offers an effective solution for managing complex application environments while reducing implementation time and costs.

Backend as a service (BaaS) is based on the same logic as SaaS, but focused on providing backend services. BaaS empowers banks and financial institutions with the tools they need to offer modern, innovative financial products. Whether it’s developing new banking platforms or enhancing existing ones, Sprinterra delivers solutions that are secure, scalable, and user-friendly. Our team of experts works closely with clients to understand their unique requirements and deliver products that exceed expectations.

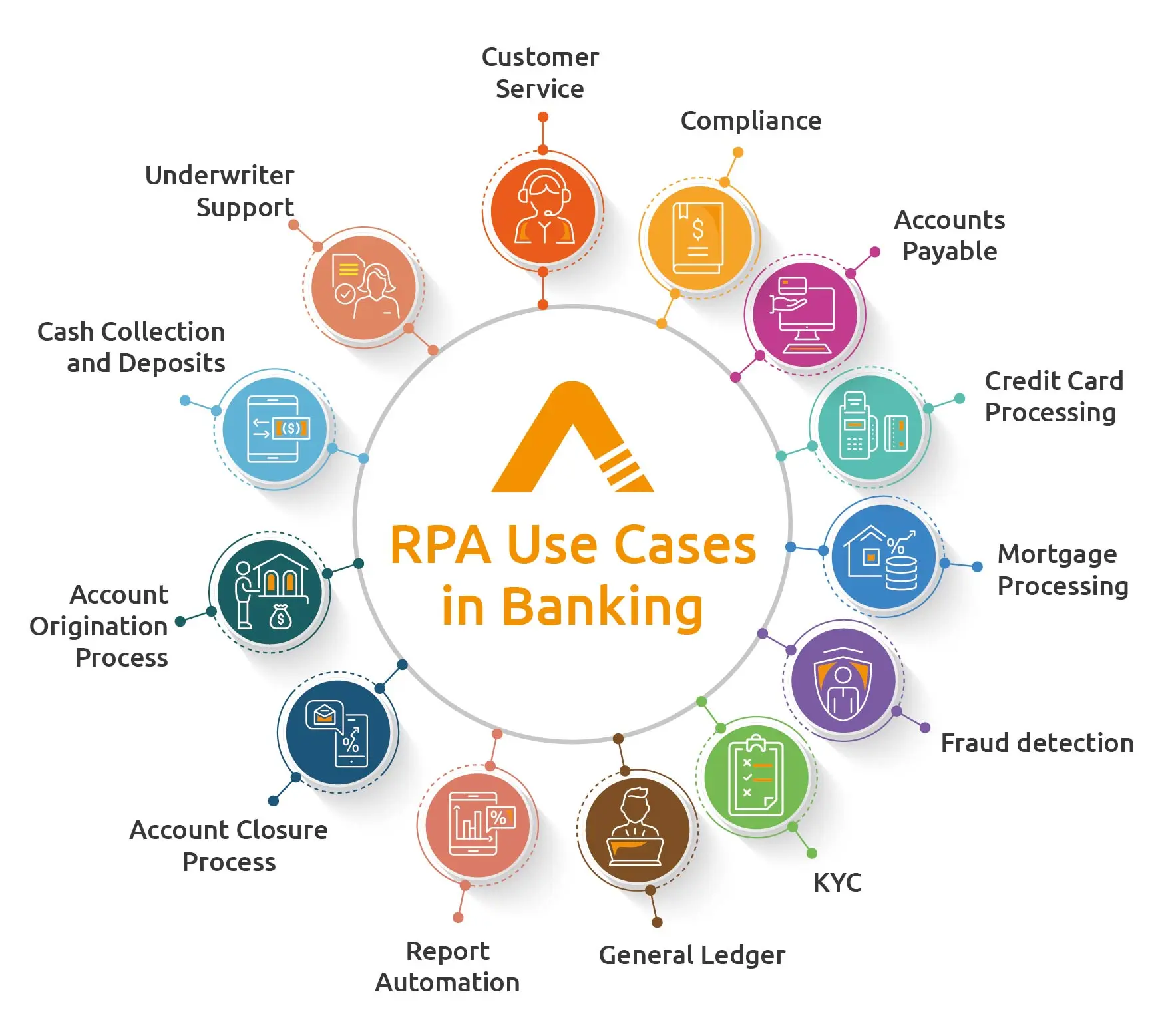

Robotic Process Automation (RPA) in financial services focuses on automating repetitive administrative tasks, such as transferring data from emails into the system. Operating at the presentation layer, RPA excels in tasks like extracting data from various sources, which can take up a significant part of the workday.

Is RPA still intangible? We’ve prepared A good case study of Robotic Process Automation In Financial Services.

Our expertise in RPA allows financial institutions to improve customer services, automate accounts payable and closure processes, enable KYC and compliance, enhance credit card and mortgage processing and improve fraud detection.

As a leading Banking Software Development Company, Sprinterra offers a wide range of services designed to meet the diverse needs of the banking industry. From custom software development to system integration and support, process automation and digitalization, our solutions are tailored to enhance operational efficiency and customer experience. Our banking software development services encompass everything from mobile banking apps to complex backend systems, ensuring that our clients have the tools they need to stay competitive in a dynamic market.

Get the latest insights on exponential technologies delivered straight to you